Complete Financial Tracker Part 2

The sequel to last edition's look at my August tracker ✌️ - PLUS check out 3 EASY tracking methods designed with beginners in mind.

Complete Financial Tracker Part 2

In this edition of the Personal Finance Project Newsletter:

Recap of Part 1

Classifications Rundown

Three Easy Methods

Prerequisites:

February 1st, 2022 - Complete Financial Tracker Part 1

October 1st, 2022 - Intro to Financial Tracking

Recap (+ Words of Relief)

3 consecutive Substacks on Financial Tracking? TBH, not even sorry about it… 🤷♂️

Last edition I shared my tracker from August 2022, which tells a descriptive story of the month’s cashflows. I chose the August tracker because it has a mix of common and uncommon cashflows, and shows how some expenses can quickly get out of hand in the craziness of life.

Before I dive into specific classifications, let’s quickly revisit our discussion on debt and taxes.

I admit, I may have gone a little overboard on the recording of taxes. Sometimes I lose perspective of the widely different skillsets and preferences of my readers, and honestly, even thinking about recording tax cashflows may be over-the-top for many people.

Please don’t be discouraged when things seem a little technical, because realistically everybody’s tracker (and tracking practices) will look different. Some people (me 🙋♂️) will build out detailed and powerful (but perhaps overcomplicated) trackers, while other people will build out basic, streamlined, and effective trackers. Both can provide great insight and help achieve the end goal - practicality within financial responsibility.

Consider This

As the PFP grows, some content will pertain to the value of diligent and specific tracking, which might seem excessive and obsessive to some readers. Other content will be focused on simple practices that can help people get started tracking, which might seem elementary to other readers. Overall, as you read through the content, remember that everyone, and their tracker, is different, and as you come across different practices simply evaluate and adopt the ones that seem best for your growth.

This goes for non-tracking-related content, too. If you collect the golden nuggets here and there, over time you’ll have a chest full of wealth.

… as for the last edition’s conversation on taxes - take what you can from it. Generally, you’ll find it easiest to just record (net) income as you get paid, followed by recording your tax payments/refunds in the appropriate income/expense table as you receive them. Simple as that.

Classification Rundown

Alright, let’s pick up where we left off, by looking at some more classifications. ▶️

Here is a copy of the summary tables shared from the last substack:

annnnnnnd here is the downloadable file (optional):

Investments (PYF) - Not sure what PYF is? See Savings 103 and/or The Wealthy Barber Returns by David Chilton for context.

My Pay Yourself First (PYF) savings goal is 10% of my income. In 2022, I was saving 10% of my net income, which I am looking to change in 2023 to be 10% of my gross (before taxes) income. I figured that I wasn't paying myself first if I pay myself 10% after taxes.

Anyway, some quick math (277.84/4321.73 = 0.064) shows that I didn’t achieve my savings goal - I only saved 6.4% of my net income and was short $154.33. In my experience, the missed target is usually just a timing issue - for example, when I get paid at the end of the month and don’t make the investment until early in the next month. This happens, and what’s important is to make up for it in future months, which I did in September. This is recorded as an under-investment in Aug and an over-investment in Sept… all the same in the bigger, year-long picture.

One personal exception to the 10% PYF rule is when my income is financed with debt, in which case I calculate my 10% PYF contribution excluding the debt financing. I do this because I don’t intend on saving and investing using debt, and doing so would put me 10% further into debt. Investing using debt is called leveraged investment… a topic I will not go into here.

Miscellaneous Shopping - This category has been around since my early days of tracking, but it’s a little hard to define. If I shop for something that doesn’t align with another classification, I’ll classify it as miscellaneous. For example, the August ledger shows that I classified my purchase of AirTags as miscellaneous, which is the most appropriate way to label the one-off shopping item. The same goes for the purchase of a phone case and screen protector.

Ultimately, this could be considered my only classification for one-off (miscellaneous) purchases. More descriptive classifications = more diligent tracking, but realistically there will always be some random transactions here and there.

I’m not much of a shopper, so this classification doesn’t usually run a high balance (except for this month). If you find yourself running a high miscellaneous shipping balance, think critically to further categorize these spending items. This will help you make more responsible spending decisions.

Physio and Health - The classification itself isn’t that interesting, but I’m sharing it with you because it is my only expense item with a positive number. Remember that negative values represent cash outflows - so a negative expense simply means spending.

So why is it positive? Well, throughout the summer I spent money on physio with the expectation that I would be covered by insurance. I received an insurance payout for previous physio transactions, which, after being added to my August physio expenses, resulted in a total (net) balance of $134.97.

This shows how I manage refunds and reimbursements - I classify them in the same way that I classified the original expense, using a positive value to represent a cash inflow. This provides me with the most accurate summary of how much I spent on the classification.

Other People - One of my newest classifications, this one is for recording transactions that I spent on someone else’s behalf (I.e. transactions someone owes me for).

I know, tracking the money that people owe me? Asshole...?

I don’t think this needs much explanation - all I’ll say is, if you’re spending money for your friends that you expect to get paid back for, you should get paid back for it. And if you’re being a generous friend, no need to get paid back for it! This classification just helps you see the bigger picture - how much you have spent on other people.

LOC Principal and LOC Interest - I’ll keep this simple. I paid off $741.42 on the outstanding balance of my LOC and $13.44 in interest, reflected by a negative value in the LOC principal and LOC interest classifications, respectively.

When I pull money from my LOC (i.e. I increase the principal outstanding), I record this using a positive value in the income table (classification: Line of Credit (LOC)). Repayments are reflected by a negative value in the expense table, as explained previously.

Unaccountable - always a low balance classification that tracks expenses whose classification is unclear.

Exchange Travels (Summary Table) - I made this table toward the end of August as a way to sort an influx of new classifications that relate to my upcoming exchange travel-related purchases. Of course, the classifications in this new table could be included in the expenses table, but I liked the idea of being able to summarize various travel-related expenses that don’t align with my typical month-to-month expenses. As my trip continued, I added new classifications as I saw fit.

This shows the absolute freedom you have in designing your tracker. I found this table useful, so I added it, and you can do the same relative to the uniqueness of your life. If you have questions on how to do it - reach out!

The function used to sum totals is “=SUMIF”.

3 Easy Methods for Beginners

I am aware that there is a wide set of skills and preferences among my readers, and the August example may not be appropriate for everyone. So, if my tracker is a little too much, let’s explore a few EASY approaches that you can use to begin.

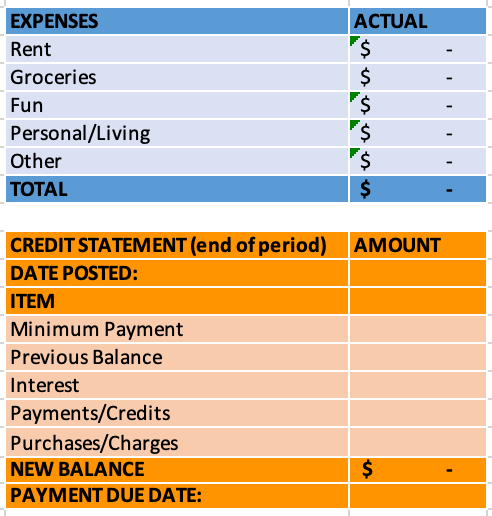

(1) Super-duper easy: Simply record your credit statement when it's posted, ignoring income, savings, and expenses.

Best for people who carry over a credit card balance every month.

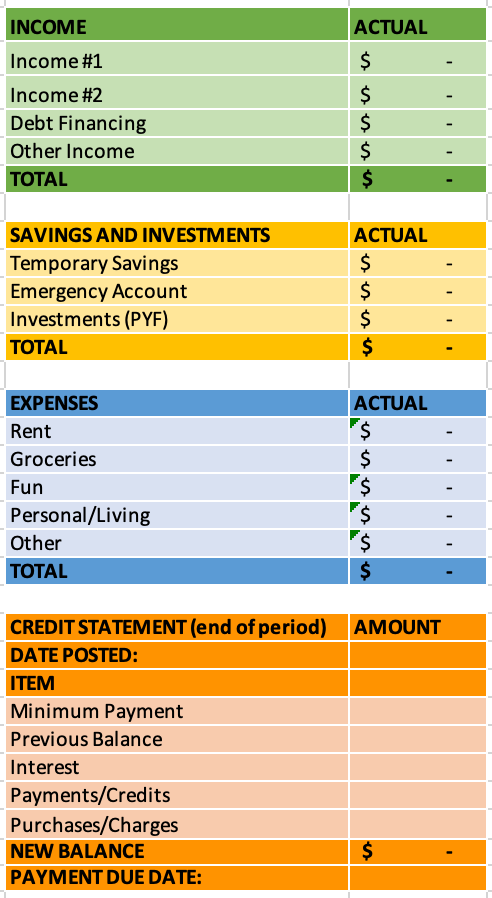

(2) Super Easy: the Super-duper easy method + 5 simple, all-encompassing expenses.

Best for people who prefer a lighter entry into tracking.

(3) Easy: the Super Easy method, but track income and savings as well.

Best for people who are all-in but need an expenses list to begin.

Wrap-Up

The most important message I can pass along about tracking is this:

Your tracker is completely your own.

This means the classifications, the layout, the recording methods, and even the colours are completely customizable!

The habit of tracking isn’t solidified overnight, though you may catch on to its value faster than you think.

I would love to see how you all have adopted the habit of financial tracking, so please feel free to share your thoughts on the tracker, or the PFP in general, using the google form. All questions are optional, so share freely!

And bonus points for anyone who shares their (blank, obviously) tracker with me, as seeing your adaptations gives me an alternative perspective.

See you in March! 🌦