Intro to Financial Tracking

Wondering where all of that hard earned cash has gone? 🫠 Download the Financial Tracker and find out today!

Intro to Financial Tracking

In this edition of The Personal Finance Project Newsletter:

🤨 What is a Financial Tracker?

🏰 The PFP Financial Tracker.

🎬 How to start TODAY!

What is a Financial Tracker?

Financial tracking is the practice of reviewing, organizing, and internalizing your past spending. The tool you use to do this is the financial tracker 🧰.

Common financial trackers generally come in two forms ✌️:

Automated financial trackers (free or costly) that attempt to categorize your cashflows for you.

Downloadable and manual financial trackers provided as a universal and ready-to-use tool.

These tools are useful for many, but often they lack a very important aspect - personalization. Personalization allows us to choose (perhaps with guidance) how our financial data is input, categorized, and displayed.

📢 A powerful and effective tool doesn’t force us to adapt to its unique design, rather the tool adapts to our unique lives! 📢

Moreover, I believe that manual financial trackers provide more value than automated versions, purely because the legitimate act of opening bank statements and inputting our transactions into the tracker forces us to see every single transaction 💪.

With that, I reintroduce the PFP Financial Tracker.

Oh, the hypocrisy!

Ok, ok… I know… 🤷♂️ you opened the template and saw what looks like a pretty restricting.

The PFP Financial Tracker is the foundation on which you can build your personalized version.

Let me explain below…

The PFP Financial Tracker

Foundational Elements

The Ledger is the section you will use to input your transactions 👩💻. It is designed so that you can read your bank statement(s) and directly copy the transactions into the ledger. The summary tables are fed the transactions from the ledger.

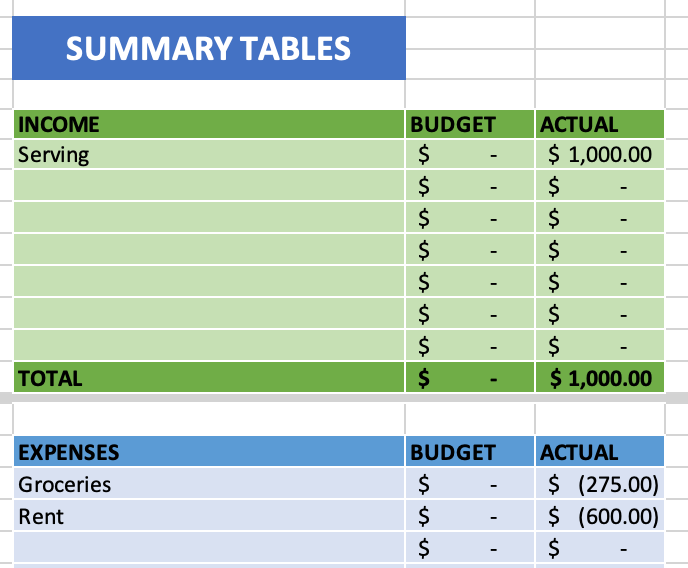

The Summary Tables takes the transactions and displays them in a comprehensible summary 🙇♀️. The foundational summary tables represent the basic divisions of cash flows - cash inflows (incomes) and cash outflows (savings & investments and expenses).

FAQ's

Can I edit my categories with the summary table after I've started?

Yes! 👍

The ultimate rule is this - for data in the ledger to copy over into the summary tables, the wording in the “classification” column of the ledger must match the category labels in the summary tables.

If you change a category name in the summary tables, make sure to go back into the ledger and rename those specifically assigned classifications too!

How does the ledger connect to the summary tables?

Under the “Classifications” table in the ledger, input the category labels that you used in your summary tables. For data to be picked up from the ledger to the summary table, the spelling in this classification column needs to be an exact match!

(PROTIP 👌: the excel equation used for this automation is the SUMIF function).

Personalizing your Financial Tracker

As mentioned above, the PFP Tracker is the foundation on which you can build your personalized version. The coordination between the ledger and summary tables provides us freedom to tailor our trackers to meet the needs of our unique lives 👔.

In future newsletters I will share some of the possibilities of personalization, including content on how to incorporate pre-made or custom add-ons into the tracker.

An example of personalization is shown in the "resources" tab of the downloadable template (and explained in the Savings 101 Edition from August 15th. This pre-made add-on feature is a Savings Account Breakdown Table, which you can add to your summary tables to display what portion of your savings accounts are assigned to each of your savings goals. As we progress, the resources tab will become a library of add-ons that you can choose from 📚.

The true value of the PFP Tracker lies in this aspect of personalization, but financial responsibility is a journey, so begin by using the basic tracker. Over time, the possibilities of personalization will come to you naturally 🌞.

How to start TODAY

Everyone has to start somewhere📍. All you need to do is to download the template, read the steps, and give it a try for yourself!

The ultimate goal is for each of us to understand our income amounts and spending habits, and luckily for us, there are many paths to reach that goal.

5 steps you can follow to begin NOW! 🎬

Locate and read through the “Tracker Steps + Template” tab (on the bar spanning across the bottom of Excel).

Consider what category labels you want to use in your summary tables. What are your biggest expenses, and your biggest sources of income? Do you have one savings account or multiple?

Split your desktop screen, with the financial tracker on one half and your bank statement on the other.

Pick a start date (ex. beginning of the month - October 1st) and begin filling the ledger with information from your bank statement!

... and how to know you're on the right track ⬇️

Unsure about if you're using the tracker correctly? Follow the visual guidance below to confirm you have set yourself up for success.

Filing Transactions into the Ledger

The date, description, classification and amount of multiple transactions have been filed into the ledger. Note that expenses (cash outflows) are negative values (type the minus symbol before the number).

Notice that two transactions have the same classification, totalling up to -$275 of "Groceries" 🍎.

Confirming Accuracy with the Summary Tables

Referencing the tracker, there should be amounts allocated to 3 different categories: "Serving"🍴, "Rent" 🏠, and "Groceries"🍊.

The Summary Table has picked up the categories used in the "Classification" column of the Ledger, and summarized the corresponding amount accordingly.

Notice that the two "Groceries" transactions from the ledger are added together to a total of -$275 in the Summary Table.

Wrapping things up

Today you have read the first entry on financial tracking.

⏰ What's to come in future newsletters:

How to personalize your Financial Tracker.

Intro to budgeting and using the Budget Table.

Excel guidance and tips for success.

✅ What we've covered today:

Introduction to financial trackers.

The PFP Financial Tracker.

How to begin TODAY.