In this edition of The Personal Finance Project Newsletter:

🤷♂️ Saving for the Sake of it - The Pay Yourself First Principle

💲 Saving versus Investing - Whats the Difference?

✍️ Author’s Note - The (Near) Future of PFP

Prerequisites

August 15th, 2022 - Savings 101

September 1st, 2022 - Savings 102

Saving for the Sake of it

Looking at the three previously covered savings principles may seem to cover all of the reasons we would and should save money… but we better cover one more of utmost importance - the Pay Yourself First Principle.

Principle #4 - Pay Yourself First ☝️

Praised by many financial figures (especially David Chilton in his book The Wealthy Barber 💈), the Pay Yourself First Principle emphasizes the importance of saving for the future. Chilton illustrates that by simply putting money aside for the sake of saving, you are actually paying your future self. This right here, paying your future self, is the most effective way to live a financially stable, sustainable and responsible life.

Let’s not overlook the first part in Paying Yourself First.

Simply put, to effectively pay your future self, you need to commit to making this payment before all others. This means skimming a certain amount “off the top” of each paycheque and depositing it right into a savings account… thats it!

Making this payment first gives you no excuses to skip saving when money is tight. 🙅♀️

By paying yourself first, the actual cash you have to operate with in this period is automatically considerate of your commitment to pay your future self. Now you don’t have the option to sacrifice your future wellbeing and instead will be forced to make short-term sacrifices on expenses (a responsible sacrifice indeed).

How to Pay Yourself First 1️⃣

(1) Decide on the portion of income that you will commit to your future self (around 10% is a fantastic starting point).

(2) Setup a savings account that you will never touch (or even look at!)

(3) On payday, transfer 10% of your payday deposit to your Pay Yourself First (PYF) Savings Account.

… next time you update your finances on the Financial Tracker, you’ll appreciate your frequent and automatic savings commitments.

Enjoying The Personal Finance Project Newsletter?

Share the Wealth! 💸

Saving versus Investing - Whats the Difference?

Three editions of the PFP Newsletter and no mention of investing… what’s the deal? 🤔

Big wins and losses 📈, market crashes 💥, success stories 🏆 …. the mere mention of the word investing makes some excited and others terrified. Im here to clear the air, and give you foundational information that we can all build our financial mindset upon.

Saving versus Investing 💰

Saving - To save is to put your money aside. Truly saving money means to store it in an account that does not face the risk of decreasing in value.

Investing - To invest is to put your money to work. When investing, you are providing money to an organization to use for their operations. You face the risk of losing this money, but the potential payoff is the additional earnings (return) that the organization may earn on your behalf.

A look at Risk and Return ⚠️

Saving = No Risk

Investing = Risk

The relationship of risk and return is a matter of degrees, meaning that undergoing different levels of risk can generate different levels of return. Extremely high risk decisions have the possibility of generating high returns, but also the possibility of huge losses. Low risk decision have a weak chance at generating high returns but provide the safety of protection from huge losses.

For example, putting money under your mattress 🛏 faces no risk, but also earns no return. Alternatively, putting your money in a volatile ("risky") asset (such as crypto currency) faces the possibility of massive earnings, or massive losses.

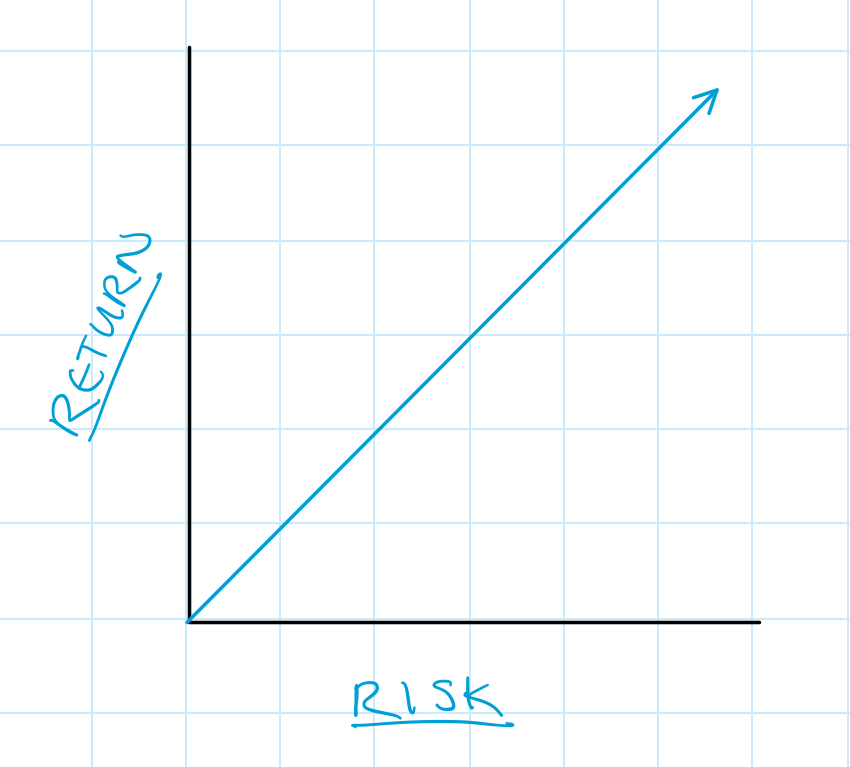

A very simple (and theoretical) visual of the relationship between risk and return.

Consider this a "line of best fit", meaning not all savings accounts and investments will fall directly on this line, but close to it!

Of course, this risk/return rule isn't absolute. There are many savings accounts that provide a slight return with no risk, and investment options that are less risky for the same return.

There are sophisticated people 🧠 writing whole textbooks on this subject, and it would be a huge disservice for both of us if I continued any further.

Just know that when you are looking to save or invest you must consider the possibilities of losing and earning money. Consider speaking to a professional (...not me 🤓) when making investment decisions.

To Save or to Invest? 🙋♂️

The rule of thumb is that saving comes first, always.

In summary, you must consider your needs in the saving/investing decision. If you need money now and in the short-term, save your current and future income accordingly. If you’ve covered your bases and you feel financially comfortable, then invest your extra money and you’ll see huge increases in wealth over time.

Check out the newly updated version of the PFP Template

The Future of PFP

Starting with three editions on savings is a demonstration of its importance. Without saving, you will find it seriously challenging to reach your short term goals, never mind a future of wealth and stability.

My vision for future content is to go beyond savings, devoting each newsletter to a specific topic which will pair with similar past and future content pieces to make different sets of series (such as the Savings Series).

⏰ Some future sets of series include:

Budgeting - The practice of forecasting future income, savings and expenses to help make financial decisions

Debt - The positives and negatives, and how to use it responsibly

Financial Literacy - Basic financial literacy and explaining the most common “finance” words

Personal Finance in Practice - Personal and real world examples of financial responsibility

Excel - Excel support, including how to use excel to suit your needs

Professional Words - Sharing popular professional personal finance content

More, more, more!

✅ What we've covered today:

The Pay Yourself First Principle

Comparing Saving and Investing - a look at risk and return

The future of The Personal Finance Project

Stay tuned!