Debt Repayment Decisions

Let's look at the powerful forces that can save you thousands on interest charges, plus bonus content for anyone with an OSAP loan.

Amortization - Repayment Decisions

In this edition of The Personal Finance Project Substack:

Amortization Recap

Impacts of Different Repayment Periods

Impacts of Grace Period and Additional Repayments

Prerequisites

November 15th, 2022 - Intro to Debt

December 1st, 2022 - Amortization

Recap from Last Substack

Last edition we met Alex. 👨🎓

Alex has an outstanding student loan of $10,000 that he must repay after graduation. Using the OSAP Repayment Calculator Alex selects a repayment period of 114 months, and the creditor establishes a minimum payment of $103 per month. The idea is that at a 3% interest rate, a monthly payment of $103 will be sufficient for repaying the total loan, with interest, after 114 months.

It’s important to realize the different variables that impact the total cost of debt.

How much would Alex save if he decided to pay off the loan in less time (i.e. he made larger monthly payments)?

Or what about the impact of making grace period payments?

Is a 1% interest rate increase significant? What about an increase of 3%? Or 6%?

We will take a look at the decisions that Alex faces through his debt repayment journey to help us understand how different strategies can help reduce the total cost of debt paid.

Let’s take a look.

Impacts of Different Repayment Periods

It’s time for Alex to make a decision… how long does he want to take to repay his loan? The OSAP website says that the average repayment period is 114 months (9.5 years, 10 years including the grace period), but why? How does this all work, and what are the impacts of choosing a different repayment period option?

Looking at the interest savings associated with picking a shorter repayment period is a great place to start.

Total Loan Period of 120 Months (10 years)

Alex’s Base Scenario (from last substack, edited)

Boxes left to right:

I changed this column to more accurately reflect the number of months of the loan (rather than months from the present day). 120 months (10 years) is the maximum length of time that Alex’s loan can be outstanding, 6 of which make up the grace period and 114 for the repayment period.

Notice the consistent minimum payments of $103, starting after the grace period.

We can see that, at the beginning of the loan repayment, almost 25% of each monthly payment is applied to interest charges and only 75% reduces the principal.

The yellow cell is the total amount repaid. Subtract $10,000 and you have the total cost of debt (i.e. total interest charges) of $1,668.82. The longest possible repayment period is the most expensive for Alex.

Total Loan Period of 66 Months (5 years and 6 months)

Boxes left to right:

Only 66 months (5 years and 6 months) to repay the loan after graduation including the 6-month grace period.

An increased monthly payment to $183.

The proportion of each payment going toward the principal increases significantly. This takes a bigger bite out of the ending balance, further decreasing next month's interest charge.

A total cost of $941.15, with savings of $727.67.

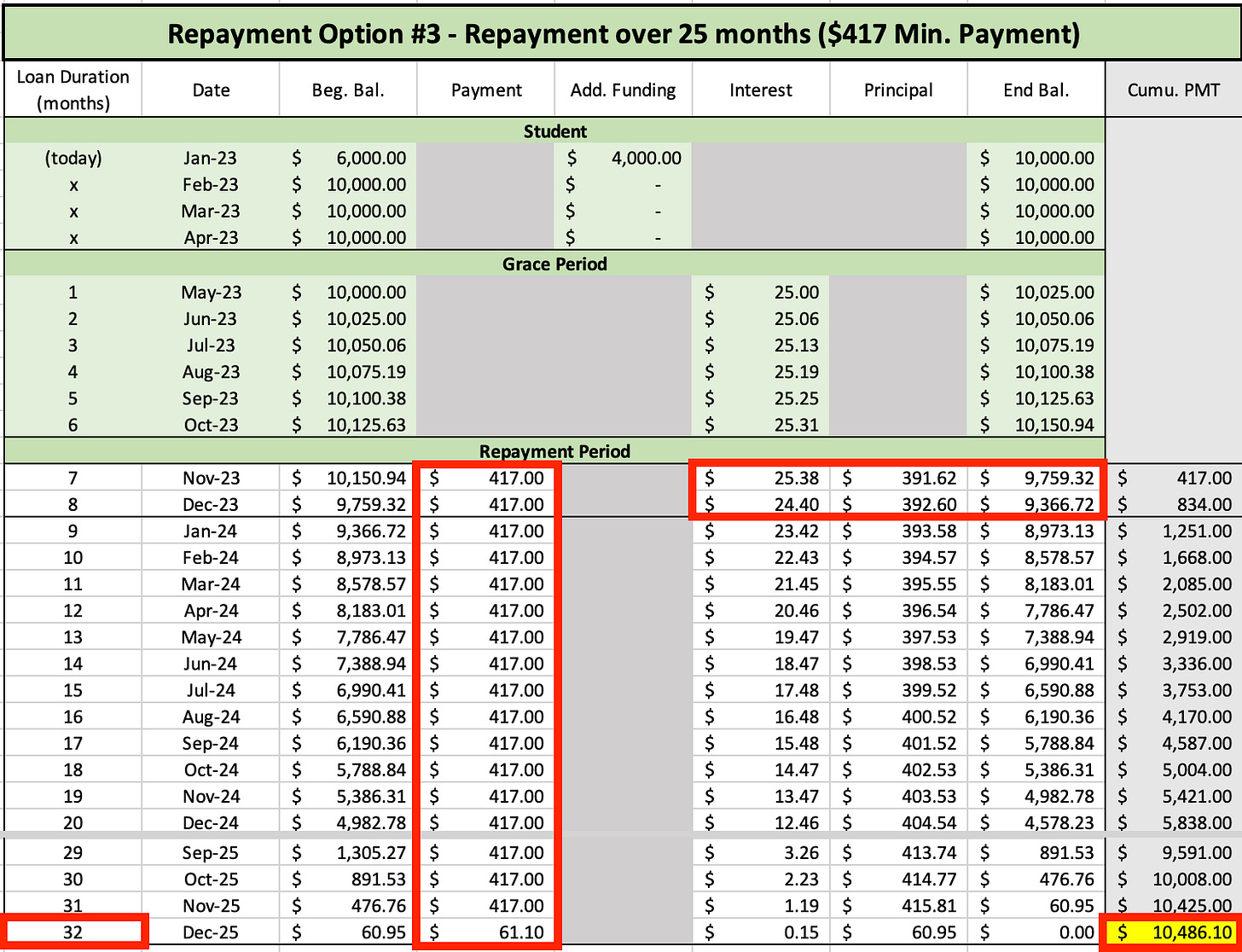

Total Loan Period of 32 Months (2 years and 8 months)

Boxes left to right:

Only 32 months (2 years and 8 months) to repay the loan after graduation including the grace period.

An increased monthly payment to $417.

Again, the portion of each payment toward outstanding principal increases significantly, fully taking advantage of compounding interest.

A total cost of only $486.10 and savings of $1202.72 compared to the first option.

Conclusions

The case that the debtor (Alex) can choose the length of his repayment, which determines the size of his minimum payment, is attractive due to its flexibility and control.

From what we’ve seen, opting for the 114-month repayment period has considerable pros and cons.

The pros: the lowest possible minimum payment gives Alex some wiggle room every month in case cash becomes tight.

The cons: this is the most expensive option, costing a total of $1,668.82.

This information should not be considered exclusively. Consider other factors before the minimum payment is committed, such as the rules around making additional payments, and the nature of the interest rate fluctuations.

Impacts of Grace Period and Additional Repayments

Of course, Alex is not a psychic.

He doesn’t know how the future will unfold, so deciding on the right repayment period may seem complex at first. By exploring the savings from shortening the repayment period, Alex is aware that a higher monthly payment means more savings. But should he commit to an ambitious repayment schedule?

Let’s explore some more, then revisit this question.

Grace Period Payments

In this situation, Alex commits to a 114-month repayment period but chooses to throw down heavy repayments during the 6-month grace period.

What exactly is the advantage of this? Well, by making grace period payments Alex is combating the interest charges that are being added to the outstanding balance during the grace period.

Boxes left to right:

Alex opted for a 114-month repayment period (a 120-month total loan period) but making grace period payments shortened the total loan timeframe by almost 20 months.

The $250 payments during the grace period, followed by constant minimum payments during the repayment period.

A large proportion of each grace period payment goes toward the outstanding principal. This proportion shrinks when Alex decreases his payment amount, but his early commitment knocked $1,358.47 off of the principal before the repayment period even started.

The total cost of debt is $1,210.66, savings of $458.15 compared to if he didn’t make the grace period payments.

More (or less) than the Minimum Payment

Most notably, OSAP accepts penalty-free additional loan repayment, meaning you can pay off the loan at any time without additional charges.

Boxes left to right:

Alex pays off his loan more quickly by making the additional payments, even though he starts 14 months into the repayment period.

The minimum payment of $103 was made until month 20, then Alex begins making additional payments totalling $200 monthly until the loan is paid off.

Notice the jump in outstanding principal repayment once the monthly payment increases. This clearly shows how interest gets paid off first, then the remaining is applied to the principal.

The total cost is $1,054.03, with savings of $614.79.

Essentially the impact of making additional payments is the same as choosing a shorter repayment period. The major difference is the commitment factor, being that in Alex’s base scenario he is only required to pay $103, instead of signing on to a higher requirement from the beginning.

And what happens if, instead of making extra payments, Alex cannot afford his minimum payment and needs to decrease it?

It will always depend on the creditor and the loan agreement. In Alex’s case with OSAP loans, there are a couple of options outlined here (for those curious).

A Note on Interest Rate Fluctuations

Another factor that should be considered is the nature of the interest charges, specifically, if they are fixed or variable. As a variable loan’s interest rate increases, this means that the portion of each monthly payment shifts more greatly toward repaying interest.

This is a natural occurrence if debt is being held for a long period. The main consideration for Alex is what happens to the amortization schedule if interest rates increase. Will this extend his repayment period? Or increase his monthly payment?

It’s best if we cover interest in more detail in a different substack, just know that all variable rate debts are subject to fluctuating interest rates, which may make the overall cost of debt greater or less than anticipated, and may require increases in the minimum payment, all depending on the specific loan.

Conclusions

In the previous section, we discovered the pros and cons of committing to a longer versus shorter repayment period.

To decrease the total cost of debt the solution is simple, pay off debt ASAP. But within this golden rule are some situations that are more or less favourable for the debtor.

Choosing the longest repayment period gives Alex the wiggle room when cash is tight, and the penalty-free additional repayments allow Alex to save money by paying off the debt more quickly.

Additionally, paying off debt early is the most powerful tool for decreasing total costs. By making grace period payments, Alex can make a big dent in the outstanding balance at the beginning and save some serious cash over time.

If you would like to see the full amortization tables, download the excel doc.

Moving On

So what does this have to do with you? And whatever happened to practicality? If it’s not clear, let me explain.

Of course, we may not be in the same situation as Alex, but anyone taking on debt can make some similar considerations, such as:

Can I choose my repayment period and minimum payment amount? If so, what commitment am I comfortable with?

Can I make additional payments toward the principal? Are they penalty-free?

Is there a grace period? And how is interest treated during the grace period?

If you are not in debt, surely Alex’s situation can show you the realities of taking on debt and what decisions might need to be made. Furthermore, you can see the necessary commitment to making monthly repayments over the long term.

Though I will not yet be adding an amortization table to the financial tools, I think that the practicality aspect is embodied through the research and understanding that any debtor should seek before undertaking the debt.

At the end of the day, you can build an amortization table for your debts, and surely it will be insightful, but simply paying off as much as you can is the best way to save money on interest charges. With that vision, you are already acting responsibly.

Next substack I will get back to something that involves direct engagement with the PFP Financial tools.

Stay tuned.

⏰ What’s to come in future Substacks:

Interest rates for beginners.

End of year financial review.

The finances of studying abroad.

✅ What we’ve covered today:

Amortization of OSAP Student Loans.

Impacts of different monthly payment amounts.

The situational aspects of a loan agreement and the impacts on repayment decisions.