Amortization

Amo-whaaaaaa? Amortization. Trust me, it's simple, and learning how to use it can save you thousands in interest charges.

The PFP and Substack

Before I get started, welcome to the Personal Finance Project on Substack!

I previously shared a welcome post with you explaining the transition. I highly suggest you check out the PFP homepage (on desktop) and download the mobile app. Of course, you will keep receiving the newsletter in your inbox regardless.

In this edition of The Personal Finance Project Newsletter:

What is Amortization?

The Amortization Table, an example.

The Relevance - more examples to come (next edition).

Prerequisites

This is a new section that I will be adding to all of my newsletters, as I am trying to emphasize the course-like progression of my content. See the welcome post for more information.

November 15th, 2022 - Intro to Debt

What is Amortization?

You all know by now that I like to start with a definition.

Amortization - Refers to the process in which debt repayment is calculated and executed. An amortized debt is one where (commonly) equal repayments are made, in which some of the repayment is interest and the rest of the repayment is applied to the principal balance.

Amortization has some fundamental characteristics:

Interest Payments and Principal Repayments

Interest is applied to the outstanding balance of the loan. Every monthly payment that you make is used to first pay off this interest charge, and the remaining amount is used toward paying off the outstanding principal.

As the next month comes around, the outstanding principal is slightly less than the previous period. This means that the interest charge for this period is also slightly less than the previous one, and since the monthly payment amount is the same, the amount of principal repayment is greater.

Every month, the proportion of the monthly payment applied to interest charges shrinks, and applied to the outstanding principal grows, until the outstanding principal is fully paid off

Monthly Payment Amount

Every creditor will establish a minimum payment amount that you must contribute each month. In most cases (but not all), you are allowed to pay more than your minimum payment. By contributing more than the minimum payment, every extra dollar you contribute goes toward paying off the principal. This, in turn, decreases the next period's interest charge, which increases the principal repayment, and so on…

The power of this is illustrated in the example below.

Fixed or Variable Interest Rates

A fixed interest rate is a rate that does not change throughout the loan repayment (pretty self-explanatory). A variable interest changes periodically depending on economic conditions.

In regards to amortization, a fixed versus variable interest rate will impact how much interest you will pay in any period. In tough economic times, interest charges may be very high, and vice versa during good times.

This is not the focus of this edition, so in the example below I assume a fixed interest rate.

Why am I even explaining this?

Well… financial education is tricky. Too much theoretical content or complex calculations will turn away a lot of curious learners. In reality, you may be advised to consistently make the minimum payment (or more) and watch your overall debt shrink, and this might be all you need to know if your goal is to simply pay off your debt.

For me, looking into the interest calculations demonstrates how impactful a smart financial decision can be. I will share this today by laying out the amortization framework, followed next week by some examples that will illustrate these impacts in more detail.

The Amortization Table

I am not afraid to say that I am in debt.

Though my situation is not identical to the example below, it is similar. I decided to use a student loan example because I feel that it may be relevant to many of my readers (and it’s an example that I’m comfortable explaining in detail).

Before I begin with the example, I must reiterate that this is in no way a suggestion on how you should treat your debt.

This is not financial advice but instead an illustration of how amortization works.

The story starts with a soon-to-be graduate named Alex. 👨🎓 Here’s his situation.

Alex has one more semester before he graduates on April 30th, 2023. In this final semester, he will take out an additional $4,000 of debt.

His outstanding principal balance (i.e. amount to be repaid) by graduation will be $10,000.

As a student, Alex is eligible for a government-issued student loan. The government (i.e. the creditor) offers a grace period for 6 months after graduation, which will extend to October 31st, 2023. During this grace period, interest is charged on the outstanding principal, but there is no required minimum payment. Note that no interest is charged to the outstanding balance during Alex’s studies, only after graduation.

(For the sake of this example) Alex will not be making repayments during the grace period.

The government is pretty flexible regarding the repayment terms. They allow you to decide on the maturity date and mention that the average repayment period is 114 months (9.5 years). This is the maturity date that Alex chooses.

The annual interest rate charged to the student loan is the prime rate + 1%. In “normal” economic conditions this equals about 3% (which is the rate Alex uses in the amortization calculations).

Given a 3% interest rate on a loan that matures in 114 months, the minimum monthly payment is $103.

Full disclosure, this is the typical setup for loans provided through Ontario Student Assistance Program (OSAP). If you have student loans through OSAP, check out the OSAP Repayment Calculator if you want to tweak some of the numbers around or explore your situation. For students outside of Ontario, the student debt amortization is likely similar.

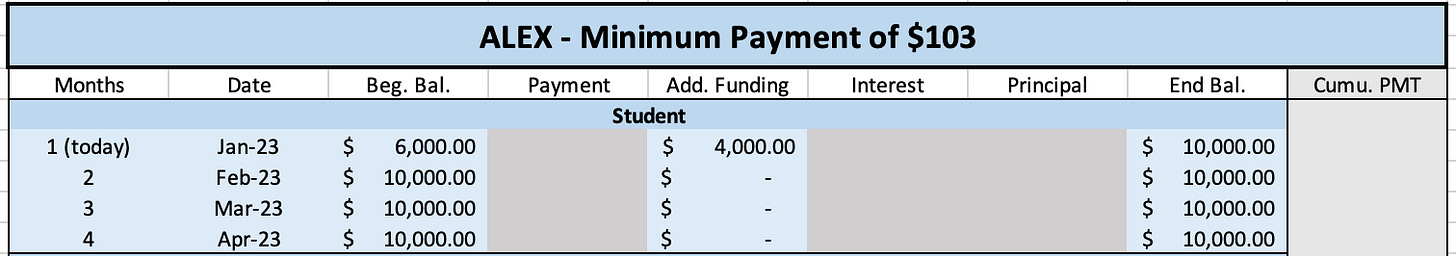

The Student Period

Here are the headings of an Amortization table, including the debt breakdown BEFORE graduation.

How to read the table

Beginning Balance = the outstanding principal at the start of the month.

Payment = the monthly payment, which is split between paying off interest charges and the outstanding principal.

Additional Funding = additional debt that is taken on by the debtor.

Interest = the interest charged to the beginning balance of that month.

Principal = the proportion of the payment that is contributed to paying off the outstanding principal (after interest is paid).

Ending Balance = the outstanding balance at the end of the month. (Beginning Balance - Principal = Ending Balance).

Cumulative Payments = the total of all payments made to date.

NOTE that the date is a month/year date (i.e. January 2023).

This first section of the amortization table is pretty simple because the loan isn’t yet being amortized. All that is shown here is that Alex used another $4,000 in January to pay tuition and that at the end of April the outstanding principal balance is $10,000. No monthly payments, no interest charges, no principal repayment… Yet.

The Grace Period

As noted above, there is no required minimum payment during the grace period (which ends on October 31st, 2023). 👻 However, beginning on May 1st, interest charges are applied to the outstanding principal balance. The interest charges are compounded, meaning that they are added to the outstanding principal, which is now subject to more interest in the next period. What's happening here is that Alex is getting charged interest on his interest.

By the end of the grace period, the new outstanding principal balance is $10,150.94.

The Full Amortization Table - Student, Grace and Repayment Periods

November 1st, 2023, is when the first payment of $103 is made. Notice that this $103 is first applied to the November interest charge of $25.38, and the remainder of $77.62 is applied to the outstanding principal. This means that on November 31st (and thus December 1st) the outstanding principal is now $77.62 less, totalling $10,073.32.

The same process is applied every month.

Observations

The interest payment is slowly decreasing over time. This is because the interest rate is applied to the outstanding principal at the beginning of each month, which is also decreasing over time. The interest charge on November 1st, 2023 is $25.38, and on March 1st, 2033 is only $0.33!

The principal repayment is slowly increasing over time. This follows the opposite trend of the interest charges.

On April 1st, 2033 (the last month of repayment), the repayment amount must only be enough to cover the remaining outstanding balance plus $0.07 of interest.

And one last thing, perhaps the most important point of this whole illustration, is the "cumulative payments" row.

Cumulative Payments

As of April 31st, 2033, Alex’s repayment amount totalled $11,668.82. When we subtract the initial principal amount of $10,000, we see that Alex paid $1,668.82 in interest throughout the loan!

Pretty interesting eh?

Amortization Considerations

Bringing all of this data into the real world, what does it all mean?

Well, that’s going to depend on you. It is very possible to thoroughly calculate the cost (in dollars) of undertaking this debt, but only when it’s put into context is when we can develop some sort of opinion on the matter.

Here are some of my quick takes:

🚫 Having to pay off debt for almost 10 years is not ideal. The mental capacity (for me anyway) taken by thinking about debt for that long is too much for my preference.

✅ Alex using loans to fund his education only cost him an additional $1,668.82 over 10 years, which seems like a good deal considering the benefits that Alex will have likely received from going to school. Of course, if he didn’t use debt, the same education would’ve cost him only $10,000. I frame this extra $1,668.82 as the cost of going to school that he couldn’t afford at the time. Though $1,668.82 is not insignificant, it’s not outrageous either.

My overall point is that, objectively, the total interest cost isn’t good or bad. It takes your unique application of this cost into the real world to determine the impact of interest costs. Of course, a $0 interest cost is best, but usually more factors must be considered.

If you would like to see the excel version of Alex’s amortization table, check it out here!

That’s All For Now

What you’ve read today is preliminary to gaining true insight into the value of understanding amortization.

Next edition I will compare Alex to a couple of his peers, who either have different monthly payment amounts or different interest rates. With this comparison you will see how these variables impact the bottom line - the total interest paid - so stay tuned!

⏰ What's to come in future newsletters:

Playing with Amortization Variables - More Examples.

Debt and the Financial Tools - Budgeting with Amortization.

Ongoing Series Additions - Savings, Tracking, Budgeting, and more Debt.

✅ What we've covered today:

An introduction to Amortization.

Alex’s Amortization Table.

Considering Debt in the Real World.

Assumptions made in my calculations:

Interest is calculated monthly, on the first day of the month. This is the same day that the payment is due.

The interest rate stays constant at 3% throughout the amortization table. This is NOT a real-life interest rate forecast for the dates displayed. Interest rates and dates were used for explanatory purposes only.