The PFP Paper Tracker

For those needing a tracking solution made simple, look no further! There’s nothing like a good old fashioned printable worksheet to remind us how simple establishing good habits can be.

The PFP Paper Tacker

In this edition of the Personal Finance Project Newsletter:

Introduction to Paper Tracking

How to Use

Online Honourable Mentions

Introducing the Paper Tracker

Why another substack on financial tracking? BECAUSE TRACKING IS ESSENTIAL FOR UNDERSTANDING YOUR FINANCES. Plus, I felt it necessary to provide an excel-alternative for my readers who would rather avoid the computer at all costs. I figured a simpler, old-school approach would be best, so print the PFP Paper Tracker, grab a pen, and get tracking!

I’ve always preferred to use excel for any sort of information tracking, but honestly, after creating this paper tracker, I am amazed at just how simple financial tracking can be. If you like to keep things simple, prefer paper over computers, and perhaps want to take your tracker around with you - the PFP Paper Tracker is the tool for you.

Introducing, the PFP Paper Tracker.

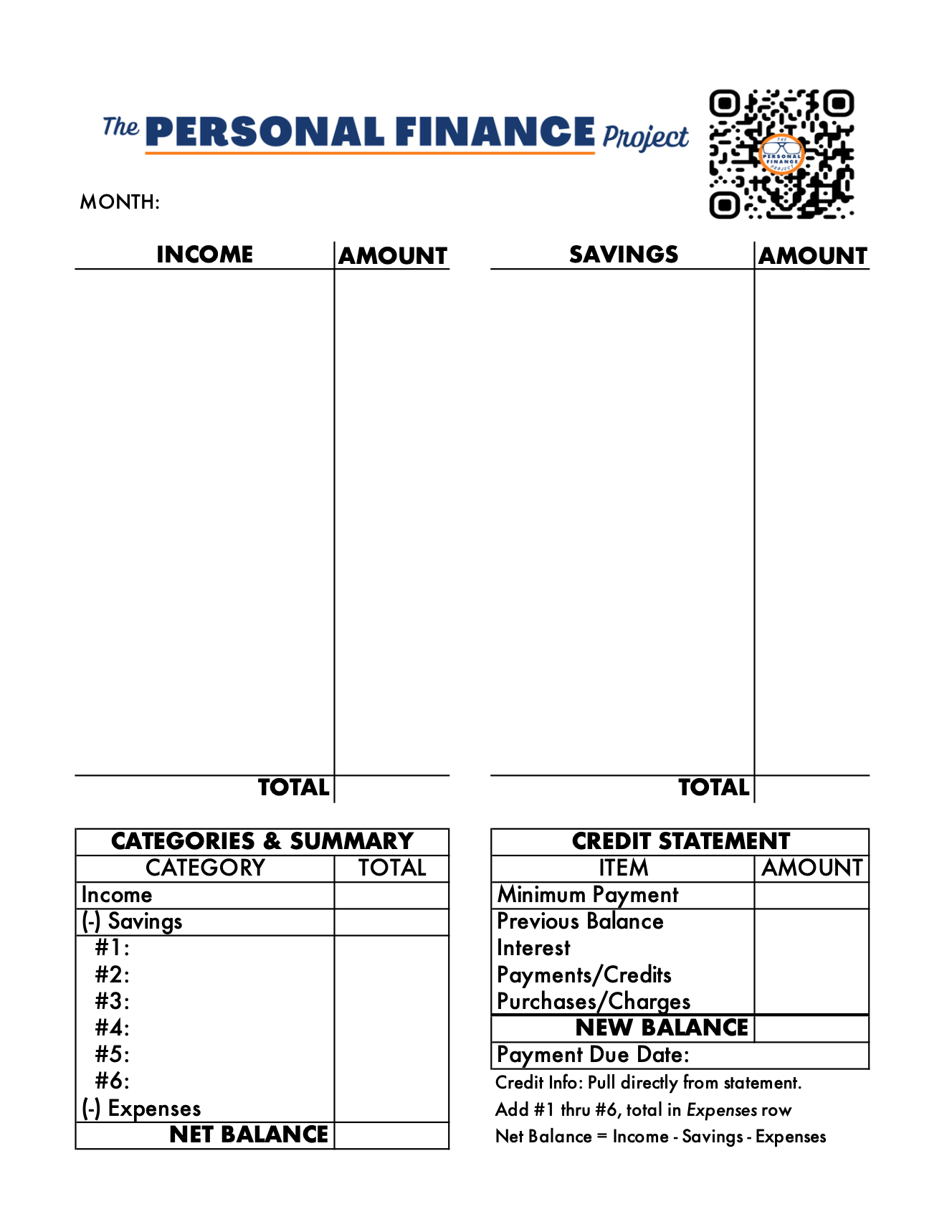

If you have read my previous pieces on Financial Tracking it should be clear how this tracker works. The paper tracker layout is built directly from the excel version but uses “T-charts” for tracking each classification instead of a “ledger” to input your data.

How to Use

Follow these simple guidelines.

Scan through both pages and acknowledge each component. On the front page, there are T-charts for Income and Savings, as well a Credit Statement table and an end-of-month Summary Table. There are 6 blank T-charts on the second page that are intended to track specific Expense categories of your choice.

Set up your paper tracker by writing the month at the top of the first page. Then, decide on 6 expense categories that you’d like to track and label the blank T-charts with these category names.

Begin and continue tracking your income, savings, and expenses by recording each transaction in the most appropriate table. Write the transaction name on the left side of the “T” and the transaction amount on the right side. Continue doing this throughout the month, in whatever system works best for you. You could try revisiting your tracker every week by inputting transactions from your banking app or collected receipts, or you can carry the tracker around with you and track transactions as you incur them.

Record credit statement information when your statement is posted (which happens at a different point in the month for everyone).

Total the transactions in each category (at the end of the month) and input this total amount at the bottom of each respective T-chart beside “TOTAL”.

Summarize your transactions using the “Categories & Summary” table by inputting the total amounts from step 5. Add up expenses #1 through #6, then use this total along with your income and savings total to calculate your net balance. As noted on the tracker, Net Balance = Income - Savings - Expenses.

If you’re not sure how to categorize your expenses, see the suggested expense categories below. ⬇️

Suggested Expense Categories:

Living → Rent/mortgage, phone & internet, groceries.

Personal → Personal/self-care, health, gym membership, makeup, haircuts.

Consumption → Take-out, restaurants, order-in, coffee, snacks, on-the-go food, booze, bar, club, social consumption.

Transportation → Car payments, insurance, gas, parking, Uber, public transit, trains, flights.

Shopping & Entertainment → Movies, sports, special events, camping, hobbies, “fun” spending, subscriptions, miscellaneous shopping, and other entertaining activities.

Other → Education, books, gifts, one-off purchases, anything else.

Also note that, concerning the previous substack, I have updated the suggested categories in the “3 Easy Methods for Beginners” section to reflect these categories listed above, since this update covers a wider range of expenses.

One more thing…

The Credit Statement Table

If you have multiple credit cards or lines of credit to track, unfortunately there is limited space on the paper tracker. Here are some options for you.

Add up the respective values from each of your credit statements and input the totals in the Credit Statement table. This will give you an overall summary of your debt, though it wont break down the information for each source of debt.

Duplicate the first page for however many credit statement tables that you need. A waste of paper, but its an option.

Do it by hand on another sheet of paper, or on the back.

Stop using multiple sources of credit - one credit card is likely enough.

Respond to this email, and I can design something for you.

Honourable Mentions

It’s no secret that financial trackers exist in all shapes and forms. A quick google search for “printable financial trackers” delivers a wide range of printable options with different designs and layouts.

Here I share with you two honourable mentions - printable financial trackers that you may find useful.

The “Budget Tracker” from housemixblog.com.

Download Tracker HERE.

I picked this one to share with you because it is very similar to the PFP Paper Tracker. It takes the T-chart approach and simplifies it - with no summary table, no credit statement table, and no pre-labeled T-charts. If you want to start with a very simple, blank page this may be a good option for you.

The “Monthly Budget Tracker” from developgoodhabits.com.

Download Tracker HERE.

If you’ve checked out the excel version of the PFP Tracker you’ll understand why I am sharing this printable version by developgoodhabits.com. Its ledger style allows you to simply enter transactions row-by-row on one table. You can even identify the transaction category within the ledger, which can help you summarize your category totals at the end of the month. Notably, there is no credit statement table and no summary table, so you may have to record these on your own.

Obsessed with Tracking

The PFP Paper Tracker (and the OG excel version) are just two of the many, many financial tracking options available to you. Of course, I would love to provide you the most value, but I am aware that we all have slightly different preferences. If you’re inspired by my obsession with financial tracking, but don’t quite vibe with the specific PFP tools, search around online and surely you’ll find something that is best for you.

That being said, I am always here to answer questions and help design financial tools that are the most powerful and useful for you - so reach out any time by responding to this email or through LinkedIn.

Until next edition!